On Feb. 5, 2018, the stock market plunged like a loud speaker tumbling from a summer concert festival stage.

On Feb. 5, 2018, the stock market plunged like a loud speaker tumbling from a summer concert festival stage.

But does that spell doom or awesome right around the corner? Like that music festival, the outcome could be disastrous or a lot of awesome. But it depends how one approaches the experience. And whether they were directly under that loud speaker — like be near-retirement an having all of their allocation in stocks.

Ever since the 1990s — really after the moment Eddie Vedder swung over my head on a microphone wire that Saturday afternoon in Lawrence, Kan. – that’s how I feel this time of year. I love a good music festival.

SXSW (South By Southwest for the concert neophytes in the crowd) will kick off next month. It used to be the standard until we digital folks took it over. For Kansas Citians, we have little “things” called Middle of the Map in May and Boulevardia in June. Then, for those willing to make the trek, there’s Bonnaroo Music + Arts Festival in June and Lollapalooza in August. An embarrassment of musical riches, really.

What do these festivals generally have in common? They often have a set, like my day with Pearl Jam, that you’ll never forget. But they often have something else. Something a lot less savory that will stick with you a long time. There’s no easy way to put this.

Some sets suck. And some days, like Feb. 5, the stock market will suck.

Some Sets Suck. And Some of Your Time In the Stock Market Will Not Be Awesome.

I recall a time when I hit a The Black Keys show. I LOVE The Black Keys. Their set was phenomenal. Unfortunately, I was as equally as excited about the opening act because they had been a college favorite. Until. That is until the lead singer stumbled across the stage largely unintelligible unless it was time to launch into a profanity-laced lashing of we, the lackluster crowd. Ugh.

How does this bad set phenomena happen? The band catches the flu right before your tour date. The roadies trash the gear (it’s rarely ever the roadies fault, I assure you). An act gets up and the lead singer can’t shake the prior night’s bender. Geesh … rock stars!

Markets can behave the same way. They’re a fickle creature, like a band poised for a bad set: Sometimes they’re suffering from bloating or some other malady and ready for a correction.

That’s what we saw a few weeks ago when the Dow Jones Industrial Average suffered its largest intra-day point drop in history.

So when that bad market strikes, what do you do? That time may be coming for a true correction. Do you bail on the show?

Several pundit immediately started comparing the plunge to the stock market crash of 1987, when the market lost more than 20% of its value in one day. There’s a lot to learn from past (not performance) but behavior.

What To Do With A Bad Set? Give Up On The Show? Bad Idea!

This is often an emotional decision. I’ve seen it. An act was so bad that beyond better judgment and regardless what might be around the corner, people leave the show.

In the 14 years I’ve provided financial education, I’ve seen emotional decisions occur all the time with the markets. And those feelings of anxiety and exasperation are especially heightened when the stock market plummets. First instinct for many is to panic and sell or make significant changes in investment strategy.

But if you do this, you could be bailing on the show before the awesome headliner hits the stage (And sorry, no amount of Instagram, Snapchat or YouTube video really captures the moment.).

Sure. When a market correction hits, it can be stressful. But it doesn’t have to ruin the show. See Jim Collins’ blog post, titled Sell! Sell!! Sell!!! Sell?. The post addresses market timing and how we largely get in our own way trying to predict outcomes.

In fact, Jim cites an internal Fidelity 10-year performance of their client accounts (2002-2013). When determining which clients performed the best, they found that 1.) deceased clients had the highest performance, followed by 2.) people who had forgotten they had an account.

If the Fidelity example doesn’t effectively illustrate the point that our attempts of dancing in and out of the market hinder performance, I don’t know what will.

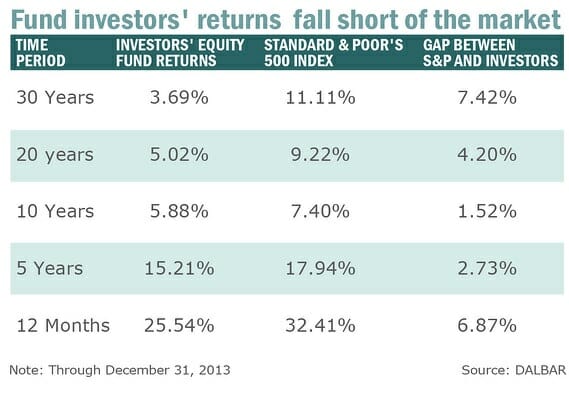

But just to prove the point with public data of the S&P’s performance vs. the individual investor’s performance:

Instead of Bailing, Flip The Stock Market Set List

Again, like a bad set, know going in that market corrections are inevitable and trying to time them is a fool’s errand. Have you ever tried to time a set list? You generally have to stay for the entire gig to make sure you hear your favorite song.

And like a bad set in a music festival, market corrections are relatively short compared to the rest of the market activity. In fact, instead of these of thinking of these as awful moments (I know. It’s hard particularly when you’ve been called a f*$&er for the 23rd time), think of them as a beneficial time – a time to hydrate if you will (hydration is important at a music festival). If you continue to invest during a correction, you could bring down your average price share and possibly benefit from greater upside when the market recovers.

On the blog Route to Retire, it takes the idea one step further. It considers not only investing during a correction, but if you feel the market is low, invest MORE than you might normally.

So, even when a set sucks, remember, awesome could be what you make of it.

Some Other Thoughts on Stock Market Timing?

Some other acts who make beautiful music about timing the stock market:

- The Penny Hoarder — Investing Mistakes to Avoid (See: On Waiting Until the Stock Market is Supposedly “Safe”)

- The Irrelevant Investor — An Unprecedented Decline (Draws some interesting parallels between this year’s plunge and 1969 and 1987)

- Mr. Money Mustache — How to Tell When The Stock Market Is On Sale (More advanced: A breakdown of P/E ratios)

- Financial Samurai — Silver Linings of a Stock Market Correction (Lessons learned including personal experiences from past corrections and crashes)

- Your Millennial Money Podcast — Smart Retirement Moves In Your 20s & 30s (Some of this could apply to those in their 40s & 50s too)